Leading up to the 2020 election, I wrote a series of blog posts titled, “The Purple Highway.”

This time around, I’m going to, once again, write a number of posts about the 2024 election called, “The Precarious Election.”

Why the Precarious Election?

It’s because this time, it looks like the election between President Biden and the former President is very close, and, so far, bears an eerie resemblance to the 2016 election rather than than 2020.

I’m going to start with an investigation into inflation, a two-parter.

Despite the creation of fifteen million jobs since January 2021, inflation has been a political liability for the President and a factor in why Biden is not beating Trump in current polling.

I’d like to suggest you can confront the issue of inflation without blaming Joe Biden for it with three words that have dominated America and the world since 2020: COVID, Oil, and War.

In this article, I will look at how inflation emerged in the aftermath of COVID-19, the frightening killer pandemic, as the nation’s society and economy were turned inside out and upside down. It started, of course, as the disease and the lockdown spread together.

2020: THE PANDEMIC AND THE RECESSION

The former President declared a national health emergency on March 13, 2020. The U.S. reached 100,000 deaths from COVID by May 25, 2020 and 200,000 deaths by Sept. 21, 2020. The U.S. had reached 233,000 deaths by October 31, 2020, a few days before Election Day, Nov.3, 2020, and 467,000 by January 23, 2021, according to the CDC. Nearly 1.2 million Americans have died of COVID since the start.

In 2020, the American economy nosedived. Between February 2020 and April 2020 the U.S. lost 21.9 million jobs as States locked down and closed schools. By the time President Trump departed in January 2021, the U.S. was still down 9.4 million jobs below February 2020 and the unemployment rate was 6.7% in December 2020. The labor force participation rate declined from 63.3% in February 2020 to 61.3% in January 2021, meaning several million people had dropped out of the labor force and weren’t counted in the unemployment rate. The economy in 2020 declined 2.77%, inflation fell in 2020 to 1.4%, gas prices dropped 15%, and US domestic oil production fell by almost 15% from January 2020 to January 2021. The Federal Reserve brought short term interest rates to zero.

2021: THE ECONOMY RE-OPENS RAPIDLY FROM THE PANDEMIC

As Joe Biden assumed the Presidency, he announced a national effort to surge the distribution of the COVID vaccine with 150 million shots in the first 100 days. The vaccines and associated health care comprise $400 billion of the President’s $1.9 trillion American Rescue Plan. By May 4th, he announced a goal of 70% of American adults getting their first dose by July 4th. It was August 2, 2021, however, before the CDC announced that 70% of American adults had received one dose of the vaccine, 60% had been fully vaccinated, and 80% of the over-65 population.

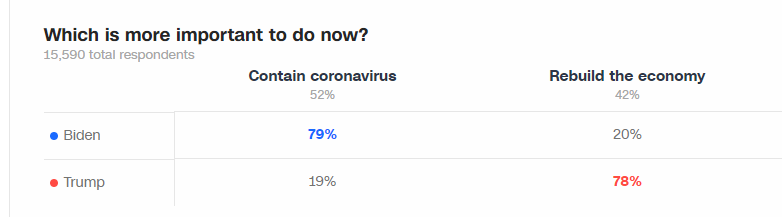

The number of Americans getting vaccinated radically slowed by fall 2021, and by January 2022, three out of four Americans reported being tired and frustrated by the pandemic, across the board among Democrats, Independents, and Republicans, according to the Kaiser Family Foundation. Democrats still considered addressing COVID to be a priority in January 2022, but Republicans reported inflation was their top priority. Nonetheless, the vaccinations were liberating America from the stay-at-home economy of 2020.

The economy had whipsawed from the COVID recession in 2020 to resurgence in 2021. The American economy gained seven million jobs, the unemployment rate dropped to 4.0%, labor force participation increased to 62.2%, GDP grew 5.9%, and inflation hit 7.0%. The economy reopened with a blast as lockdowns ended, schools reopened, Americans hit the road, and spent money. The Republicans blamed Biden for inflation. Essentially, the argument was that his government spending was the source of too much money in the economy and the source of inflation.

Was Biden’s stimulus package really the big guilty party in an economy awash from money from many sources?

BY 2021 THERE IS FAR MORE MONEY IN THE ECONOMY THAN WHAT JOE BIDEN PUT IN

Cash came from all sources to Americans’ pockets in 2020 and 2021. The Federal Reserve, doing its part to save the economy during COVID, reduced the Federal funds rate to 0.0-0.25% on March 15, 2020, and introduced many measures temporarily easing credit and lending to assure the full flow of money through the economy. Lower interest rates packed their own wallop. The Standard & Poor 500 rose 16% in 2020 despite the brief plunge in March 2020, and rose another 27% in 2021, with both years’ boosts also driven by rapidly rising corporate profits.

Rising stock market prices contributed to money in American pockets. Capital gains realizations in 2021 from sales of assets in the United States like stocks (including stock buybacks), bonds, and real estate were estimated to reach $2 trillion, equivalent to about 8.7% of GDP. (Capital gains are not actually counted in United States GDP accounts because they are the transformation of existing assets from one form to another, not income.) Nonetheless, lots of that cash is flowing into Americans’ pockets, no matter how it might have been spent or reinvested.

Did Joe Biden hurt you because the stock market did well and produced a lot of money for people?

Low interest rates in 2020 and 2021 also sparked a mortgage refinancing boom. 14 million households refinanced their mortgages and extracted $430 billion in equity, and reduced their interest payments by $24 billion a year between the second quarter of 2020 and the third quarter of 2021. It’s hard to blame Joe Biden for people refinancing their mortgages.

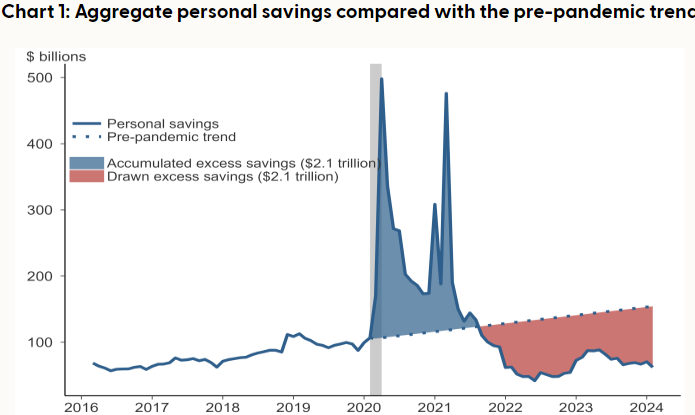

Despite the turmoil of the pandemic, the Federal government’s several stimulus packages had put large amounts of money in the pockets of Americans. Government fiscal support relief was far from the only source of savings, as I described above. In addition to capital gains and mortgage equity extraction in 2020 and 2021, Americans had saved money from not traveling, working remotely, not dining out, and halting all kinds of leisure and entertainment activities. These sums were described as excess pandemic savings and are detailed in this St. Louis Federal Reserve Chart:

The three peaks of the chart correspond to the three major Federal stimulus packages. The first peak, the Cares Act signed in March 2020 by then President Trump, put $2.2 trillion into the economy, including $300 billion in direct stimulus payments to individuals and $260 billion for enhanced unemployment insurance. The second peak is the smaller Dec. 27, 2020 appropriation act also signed by President Trump, providing another $900 billion to the economy, including $166 billion in further direct $600 stimulus checks to individuals, and $120 billion in further unemployment relief.

President Biden’s $1.9 trillion American Rescue Plan, the third peak in the chart, provided $400 billion more in stimulus payments but capped them at $75,000 for single taxpayers and $150,000 for married couples, and provided $300 billion for supplemental unemployment relief through September 2021. Vaccine distribution, health care system and small business relief, the child tax credit, assistance for school reopenings and state and local government relief, filled up most of the remainder.

Demand for goods and services in the United States were affected by all these accumulations of cash in 2020 and 2021, including President Biden’s American Rescue Plan. The American Rescue Plan was 40% of the three government COVID spending packages. When all the other sources of money, mortgage refinancings, capital gains, and avoided private expenses like halting travel were added to Americans’ total new sources of funds, the American Rescue Plan’s contribution dropped far below 40%.

But there was a set of shortages contributing to inflation too!

SHORTAGES, CARS, AND CHIPS

COVID drove down US new vehicle sales 15% from 2019, dropping to about 14.5 million vehicles from 17 million, but new vehicle sales barely increased at all in 2021, to 14.9 million. Computer chip shortages worldwide were seen as the major culprit in the inability of the US car industry to increase auto production. Inflation in new car sales in 2021 rose almost 12%, and in used cars 37% as consumers were driven into the used car market. Based on what portion of the Consumer Price Index is represented by new and used vehicles, the rapid price increases in the vehicle sector contributed 1.8% of the 7.0% rise in the CPI in 2021 (author’s calculations). The chart below shows the dramatic impact of price increases for vehicles in 2021.

OIL

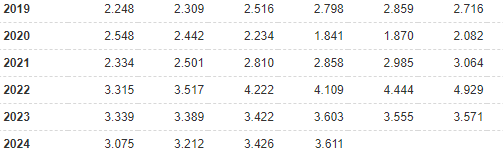

I haven’t talked about oil. Part of talking about the price of oil starts with coming to grips with the fact that the U.S. Government (Donald Trump, Joe Biden) doesn’t control the price of oil. An international cartel of major oil producers like Saudi Arabia, other Persian Gulf producers, Russia, and Nigeria have the dominant influence on the price of oil. The United States government does not tell domestic producers of oil in the US what to charge either. Here’s a table from the US Energy Information Administration on the monthly price of regular gasoline in the United States, from January-June 2019 to the present:

January June

From June 2019 to June 2020, as COVID strikes the economy, the price falls from $2.71/gallon to $2.08/gallon as demand for gasoline plunges. As the economy recovers in 2021, the price rises about 50% from June 2020 to June 2021, from $2.08/gallon to $3.06/gallon. Demand for oil is also reflected in the worldwide recovery from COVID as international forces continue to set prices. The price of crude oil is the dominant factor in 2021 price rises. On June 22, 2020, the price of crude oil is $38/barrel. On June 21, 2021, the price of crude is $74/barrel. On a per gallon basis, the impact of the rise in the price of crude oil in the US on regular gasoline was 86 cents out of the 98 cent rise in the cost of regular gasoline.

A general economic recovery from COVID would have driven increased demand for oil, even with smaller government fiscal support in the economy, as Americans hit the road in 2021.

In fact, in 2021, based on the contribution of the price of gasoline to the overall consumer price index, the 50% rise in the price of gasoline in 2021 contributed two points to the rate of inflation, effectively all of it a rise in the price of crude oil.

Joe Biden was not responsible for the rise in the price of crude oil in 2021.

Combined with the rise in the price of motor vehicles, heavily related to the computer chip shortages, vehicles and oil contributed 3.8% of the 7.0% rise in inflation. And the War in Ukraine hadn’t started.

CORPORATE PROFITS

An analytical article in the conservative Wall Street Journal explored rises in costs and rises in profits among major American corporations and concluded excess corporate profits were contributing to a 1% increase in prices across the Board compared to where corporate profits were before COVID. I am sure plenty of people on the left would argue that greedflation had a bigger impact, but if the Wall Street Journal says one percent, I will take it.

THE UPSHOT

Was Biden’s American Rescue Plan (ARP) the driving force in inflation in 2021? Of course the ARP was a factor in increasing “aggregate demand” in the economy. But there is too large an accumulation of other factors to make the ARP the central factor.

President Biden didn’t cause the stock market boom in 2021 and the mortgage refinancing boom, both of which resulted in huge cash flows to Americans in 2021. The ARP didn’t cause the chip shortages driving auto prices upwards in 2021. Americans getting vaccinated, liberating themselves from the stay-at-home economy, and hitting the road were independently creating demand for oil, American Rescue Plan or not.

My take on inflation goes through a logical process of exclusion by taking car and oil price rises, excess corporate profits, private cash jumps of capital gains, mortgage equity, and stay-at-home savings, to crowd the ARP into between one and two points of the seven percent rise in inflation in 2021. And remember: Biden doesn’t control the price of oil and he doesn’t start the War in Ukraine in 2022.

0 comments on “THE PRECARIOUS ELECTION: Why Biden’s Not to Blame for Inflation, Part One: COVID Turns the World Upside Down”