The Republicans who control the House and Senate have begun their process to pass a giant Budget Reconciliation package of tax and spending cuts for Fiscal Year 2024-2025.

And oh, what an insane package it is.

The destructive potential of the Republican’s agenda is astonishing, both in the harm to ordinary people from cuts to Medicaid, food stamps, housing, schools, and science, and to the rapid acceleration of the national debt coming from tax cuts concentrated among the wealthy. After all, the starting line is the current year Federal deficit, projected at about $2 trillion by the Congressional Budget Office.

After an April 28th meeting, Speaker Johnson said the House goal is passage by Memorial Day. Treasury Secretary Scott Bessent said the goal for the two Houses is the Fourth of July. There has already been slippage in the schedule of committee markups of legislation, indicating even that timetable is ambitious.

The Federal Debt Explodes: More Tax Cuts for the Wealthy??

The irrational, virtually nonsensical explosion of the Federal debt that would be occasioned by the extension of the Trump tax cuts, along with more tax cuts from his campaign promises, prompted some Republicans to suggest at least restoring the old top income tax rates for taxpayers making over $1 million a year.

The Speaker and President Trump claimed they were rejecting the idea, only to have President Trump reverse himself again saying, on May 8, taxes on the wealthy should be raised.

The situation is fluid and the idea is unlikely to go away, especially as the Democrats continue their denunciations of spending cuts while the wealthy get rewarded. Polls show even a majority of Republicans, let alone everyone else, support raising taxes on the wealthy and big business.

When even Republicans raise the issue of cutting off the extension of the tax cuts at a level of $ 1million or more, the benefits to the wealthy and big business that have already occurred amidst America’s oligarchy can’t help but come into focus.

(As I will discuss further in this article, even if the Republicans cut off the extensions of the tax cuts at $1 million a year and set a higher rate for that level, it would deceive the public because so much of the money of the wealthy is not in wages and salaries, but in capital gains and partnership income which is taxed at far lower rates. And the bracket and rate changes from tax cuts that occurred lowered the taxes on the first million dollars people make. It’s unlikely these would be undone.)

I estimate tax cuts enacted by Republicans are already to blame for half the current $2 trillion mismatch between Federal revenue and spending. We have had a generation of relentless tax cuts, starting with the George Bush II years through Trump.

In 2017 the Republican Congress passed the Tax Cuts and Jobs Act, which included large permanent corporate tax cuts and a set of individual and business tax cuts that expire at the end of this year. The coming months will become a chaotic, lurching contest among Republican factions and Trump before they enact Crazytown 2025.

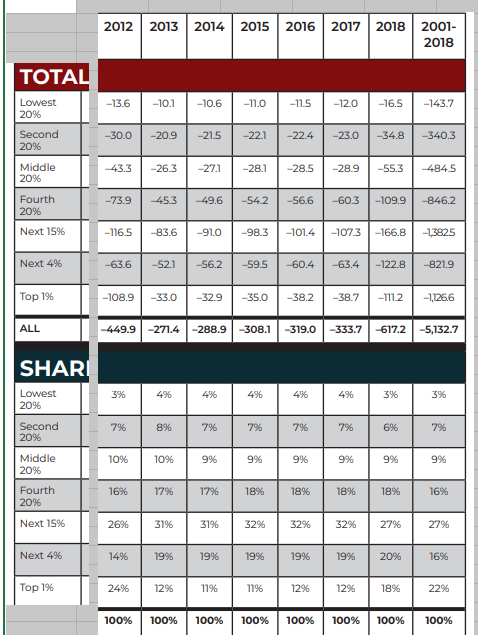

Here’s a table from The Institute for Taxation and Economic Policy showing revenue losses and shares 2012 to 2018:

In the table above, 2012 is the final year before the Bush tax cuts expire. Revenue losses on an annual basis in that year were $449.9 billion, compared to the pre-Bush II era. The top 1% got 24% of the benefit, the top next four percent got 14%, and the top 20% got 64% of the benefit. President Obama cut a deal to allow all the Bush tax cuts to be extended except for the top 2% of taxpayers. That change is reflected in the 2013 column that dropped the annual revenue loss to $271 billion due to higher rates on the wealthy.

The 2018 column shows the revenue loss and increase in the deficit when Trump’s Tax Cuts and Jobs Act was enacted. Before the Trump cut the revenue loss (and deficit impact) of the Bush years, modified by Obama, on an annual basis was $333.7 billion in 2017. and increased due to the Trump tax cut to $617 billion a year in 2018, dropping revenue by almost $300 billion in just one year. The table does not reflect estimates of increased interest payments on additional debt from the Trump tax cut, which rose from $75 billion in 2017 to $116 billion in 2018.

In 2018, with the Trump cuts in place, the top 1% of US households were getting 18% of the tax cuts, the top next 4% 20%, and overall, the top 20% got 65% of the tax cuts. Since personal income, without adjusting for inflation, has risen about 50% since 2018, a simple projection would shift the value of the combined Bush and Trump tax cuts from $617 billion a year to about $ 925 billion a year compared to 2000, which President Clinton had ended with four years of surpluses in a row. Increased interest costs associated with the increased debt from the tax cuts add about $ 170 billion to the annual deficit, for a total impact to the annual deficit of $1.1 trillion out of the $2 trillion current year deficit.

Of course, an assertion that these tax cuts alone created half the deficit could be disputed, but I show the numbers to create a context for this next stage of irrational tax cutting.

Chaos! Trump’s New Tax Cuts Add Up to At Least $2 Trillion in Lost Revenue

The House Ways and Means Committee markup for tax legislation is currently scheduled for the week of May 12th. The House Budget instruction to the committee adopted April 10th set $ 4 ½ trillion in tax cuts through 2034, while the Senate instruction set $ 5.8 trillion in tax cuts. These numbers don’t count additional interest costs.

Trump himself is a chaos agent in the process, since he wants to count revenue from tariffs (which, as far as I can tell, nobody is buying) and has suggested a new tax cut for Americans making under $200,000 to compensate for price increases related to tariffs, along with an increase in the top rate. The House, Senate, and Trump would then still have to contort themselves to accommodate the promises made during the campaign, eliminating taxes on tips, overtime, and social security.

Using a Tax Foundation analysis, I estimate just those three deficit-busting promises add up to an additional $2 trillion in lost revenue over a 10-year period.

The expiring individual income tax cuts from the first Trump administration are estimated to cost almost $4 trillion in revenue through 2034, according to an April 3rd letter from the Congressional Budget Office to four Democratic legislators. The CBO letter showed revenue losses reaching $400 billion a year by 2027 beyond the present deficits. The Committee for a Responsible Federal Budget said just the Trump tax cut extension alone was equivalent to the Social Security Trust Fund shortfall. There are also expiring business tax cuts.

The Wealthy Still Reap the Most from Proposed Tax Cuts, Even If You Add Back a Higher Rate

As I indicated, the tidal wave of debt associated with so many tax cuts is a reason some responsible Republicans might keep pushing to stop the income tax cuts at some income level like $1 million a year and raise the rate at that income level back to the old 39.6% from the current top rate of 37%. That still goes nowhere near the mountain of special tax treatment of the wealthy.

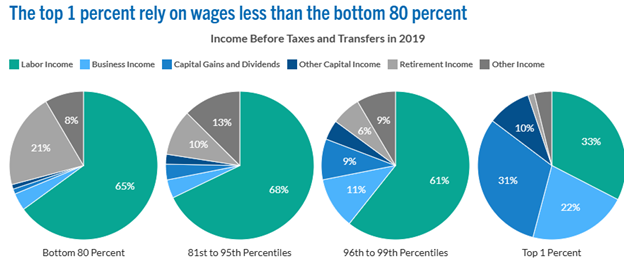

This pie chart from the Peterson Foundation shows the sources of income for Americans with different income levels:

For the top one percent, 31% of their income comes from capital gains, currently taxed at a top rate of 20% (the first $600,000 is taxed at 15%). Trump’s Tax Cuts and Jobs Act also created a special break for pass-through income, used by many partnerships in real estate, law, accounting, or small businesses. That special break allowed a business deduction of 20%, taxed at 29.6%, for that income. 22% of the income of the top 1% comes from business income where these deductions are available. Only 33% of income of the top 1% comes from wages and salaries, where the top marginal rate would apply. Even among the next top 4%, only 61% of their income comes from labor compensation. For a married couple the estate tax doesn’t kick in unless the estate is valued at $22 million.

Corporate tax cuts enacted in 2017 were permanent and brought top rates from 35% to 21%. These revenue losses can reach $150 billion a year, extrapolating from the Institute for Tax and Economic Policy estimates adjusted for the doubling of corporate profits since 2018.

The largest protections for wealth in the United States would continue to go unprotected, the step-ups in capital gains at death, which enable very wealthy Americans to transfer hundreds of billions of dollars without paying taxes on assets like stocks purchased twenty, thirty, or forty years ago.

Crazytown Budget Could Destroy Medicaid, Social Security, Country’s Finances: With Blowback from Constituents, Will Republicans Allow It?

These contradictions have become so obvious to the Republican leadership that House Ways and Means Chair Greg Smith is meeting with President Trump over possibly scaling back the tax cuts altogether. Republican moderates have panicked about being defeated in 2026 if big Medicaid cuts go through and are claiming they would refuse to vote for them. That inability to cut spending is the stumbling block to the tax cuts.

The House Energy and Commerce Committee, with responsibility for the Medicaid program that affects 90 million Americans, postponed its legislation markup to the week of May 12 as it gets ready for votes. (I wrote about the impact of large cuts to Medicaid in New York in March 2025.)

Will this proposed budget pass?

As reality gets in the way, the current proposed timeline for the budget is simply not going to happen. I think we can say goodbye to the House budget by Memorial Day and the Reconciliation bill by July 4th. All they are talking about is the current Fiscal Year. Whenever they finish, they will have to pivot to Trump’s new so-called “skinny” budget to start in October.

The whole process is already off to a rocky start. Scale back, implode, or end with a whimper? I guess we will have to wait and see.

Discover more from Jim Brennan's Commentaries

Subscribe to get the latest posts sent to your email.

0 comments on “Crazytown 2025: Republicans Create Fiscal Chaos, Destructive Budget Proposal; What’s Going On?”