The fracture point – the point at which Social Security will become insolvent – for the Social Security and Medicare Trust Funds was accelerated by one year, from 2033 to 2032, upon the passage of the One Big Beautiful Bill Act (OBBA) by the Republican-controlled Congress and signed by President Trump on July 4th, 2025.

The breakpoint for the Social Security Trust Fund will come when it has depleted its reserves and can only pay benefits limited to the revenues coming in.

Every year, the Trustees of the Social Security and Medicare Trusts release their Annual Report. The 2025 Report was released on June 18, 2025, sixteen days before Trump signed the OBBA into law. This year’s summary of the Report stated that, “The Old-Age and Survivors Insurance Trust (OASI) will be able to pay 100 percent of total scheduled benefits until 2033, unchanged from last year’s report. At that time, the fund’s reserves will become depleted and continuing program income will be sufficient to pay 77 percent of total scheduled benefits.”

The One Big Beautiful Bill Temporarily Increases Deductions For Seniors But Curtails the Steady Flow of Funds to the Social Security Trust Fund

The new law provides a massive increase in the standard deductions for age 65 and over filed on individuals’ and married couples’ tax returns. An extra deduction of $6,000 for single senior citizen filers, and $12,000 for married filing joint, are stacked on top of the regular standard deductions, which already have an extra benefit for seniors. For a senior citizen couple in 2026 taking the married filing joint deduction, the regular standard deduction, the extra age 65 plus deduction for each person, and the new $12,000 OBBA deduction will bring the total to $46,700 before any taxable income would start to kick in.

Shielding more income from taxation includes any taxation of social security benefits below the standard deductions. Since revenue from taxation of social security benefits goes by law to the Trust Funds, shielding more of that revenue indirectly reduces the flow of funds to the Social Security Trust Funds. The Committee for a Responsible Federal Budget estimated the impact of the bill would reduce total taxation of benefits by about $30 billion a year, pushing the insolvency date from 2033 to 2032, and also adding one point, to 24% rather than 23%, to the benefit cut estimated by the Trustees. The big increases in standard deductions for seniors expire in 2028. If extended, that would further speed up the Trust Funds’ insolvency.

The Social Security Administration Sent Out Misleading Information After Passage of the OBBA

The Social Security Administration sent out an email on July 3rd, after Congress had passed OBBA, heralding benefits to Social Security recipients upon passage but providing misleading information about how the bill affects taxation of Social Security benefits.

The email contained one vital misstatement and one vital omission. Congress did not directly exempt taxes on Social Security benefits- it shielded them from having to be paid through the whopping increase in the standard deduction. And it also did not tell beneficiaries that “about 64% of senior citizen Social Security beneficiaries had exemptions and deductions that exceeded their Social Security taxable income, according to a White House Council of Economic Advisors analysis.” In other words, 64% of seniors already weren’t paying taxes on their Social Security benefits.

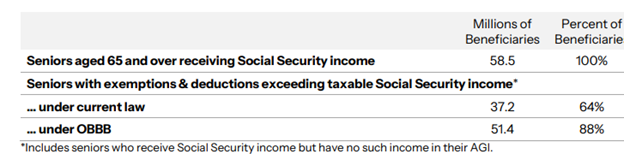

The White House Council of Economic Advisors (A Trump administration entity) presented the figures this way in their analysis, including the fact that under OBBA the number of seniors with their Social Security benefits shielded from taxation would be as follows:

The bill increased the percentage of seniors who won’t pay taxes on their Social Security benefits to 88% under the new law, up from 64% under current law. Persons age 62 to 64 starting to take their Social Security won’t benefit because they are under 65, as would persons under 65 on Social Security Disability or survivors under 65.

Affluent single seniors will see their $6,000 extra standard deduction phase out starting at incomes over $75,000 and fully phase out at $175,000, and married filing joint seniors will see their $12,000 benefit start to phase out at $150,000 and fully phase out at $250,000. Their regular standard deductions would continue.

Social Security’s Shortfall Has Been Known for Years, But the OBBB Will Accelerate Its Insolvency

It’s not like Congress and the Presidents of both parties haven’t known about the shortfall over the past ten years. The Center for Budget and Policy Priorities publishes a summary of the Social Security Trustees report every year. In those summaries, in 2015, the Trustees reported the break point would be 2034; by 2019 and 2020 the report said the breakpoint had improved to 2035, but dropped in the 2021 report to 2033 as a result of the economic impact of the COVID pandemic. In 2024 the Trustees report also showed the breakpoint to be 2033. The One Big Beautiful Bill has now moved that break point up to 2032 with its reductions to contributions to the Trust Funds.

What Can Be Done? What Solutions Have Been Proposed? How Likely Are Republicans to Act?

Are candidates for Congress going to talk about Social Security insolvency in the 2026 midterms? Will candidates for the Presidency talk about it in the 2028 Presidential election? Imposing the payroll tax on much higher incomes than the current income cap for the Social Security payroll tax, $ 176,100 in 2025, for instance, on wages of over $400,000 a year, would rapidly resolve the insolvency problem for decades. But that necessitates the party in power, the Republicans, to reverse course and impose big new taxes after they just passed massive tax cuts and ignored their national debt-busting consequences. Getting the two political parties, now at bitter loggerheads, and the ever-vengeful President Trump, to focus on resolving Social Security’s problems seems almost impossible right now, as necessary as it is.

The acceleration of Social Security and Medicare Hospital Insurance insolvency leaves only three elections for Congress and a President to shore up the system before benefits are cut- 2026, 2028, and 2030. 2032 could be too late because the benefit cut is likely taking place sometime in 2032. Every year’s delay also forces sharper and sharper tax increases and/or benefit cuts, or both, to assure the solvency of the system for the long term and avoid a lurching benefit cut in 2032. A recession or slower economic growth than anticipated could accelerate the fracture point sooner.

The last time the Social Security system was overhauled in a major way was 1983. President Reagan appointed a 15 member Bipartisan Commission in 1981, chaired by Alan Greenspan, a leading Republican economist who later became Chair of the Federal Reserve Board, with some commissioners appointed by either Democratic House Speaker Tip O’Neill or Republican Senate Majority Leader Howard Baker. They were tasked with providing a report after the 1982 midterms to shore up the Social Security system, which was then out of balance while Congress covered its deficits from revenues from the General Fund.

An extraordinary compromise between the Democratic and Republican parties provided the basis for major reforms, in which the Republicans agreed to some tax increases and the Democrats agreed to some benefit cuts. A cost-of-living adjustment was delayed by six months and a series of payroll tax hikes were accelerated. Middle and upper-income Social Security recipients were required to pay taxes on some of their Social Security benefits, payroll taxes were raised on the self-employed, and coverage was expanded by bringing in new Federal employees and preventing state and local employees from withdrawing. A gradual rise in the retirement age was phased in over several decades from age 65 to age 67, which was not completed until 2022.

The reforms led to surpluses in the early years, but those surpluses have dwindled and are being drawn down now. It is generally believed that the political success of the compromise was due to the support of Republican President Reagan and Democratic House Speaker O’Neill.

A poll taken by the Senior Citizens League among Americans 62 and over indicated eliminating the income cap on payroll taxes was the most popular reform proposal, with 50% support. Raising the retirement age to 70 drew 18% support, and a mere 1% supported cutting cost-of-living adjustments. The opinions of persons below age 62 were not solicited. Allowing the government to invest the Trust funds in stocks and bonds had 19% support.

The list of entities proposing ideas to protect solvency is considerable. They include the Chief Actuary of the Social Security System, the Congressional Budget Office, the General Accounting Office, the Brookings Institute, the Committee for a Responsible Federal Budget, the Peter G. Petersen Foundation, and the list goes on.

The National Committee to Preserve Social Security and Medicare offers a Legislative Tracker on its website to provide information on bills in Congress affecting those two programs. This Committee is a progressive organization. One major bill is Senator Bernie Sanders’ Social Security Expansion Plan, which would raise Social Security benefits by $2,400 a year and fully fund the system by imposing the payroll tax on incomes above $250,000 a year. It’s just one of many bills.

It’s hard to imagine a solution to the pending crisis that would not be bipartisan. But the crisis is around the corner, with just three elections to go.

Discover more from Jim Brennan's Commentaries

Subscribe to get the latest posts sent to your email.

0 comments on “Trump and Republican Allies Speed Up Social Security’s Insolvency Date”